A short sale is the sale of a stock that an investor does not own or a sale which is consummated by the delivery of a stock borrowed by, or for the account of, the investor. Short sales are normally settled by the delivery of a security borrowed by or on behalf of the investor. The investor later closes out the position by returning the borrowed security to the stock lender, typically by purchasing securities on the open market. Most brokers don’t charge any trading commissions on stocks and have no account minimum to get started. But you could also go with a trading app, especially if you want to trade less frequently via a mobile device.

When people talk about investing in stocks, they’re usually referring to common stock. These kinds of stocks give you the opportunity to join in the success of public companies, and as such, they’re an investment that can really grow your portfolio. You don’t need thousands of dollars to start investing in a stock. You can buy a stock at its market price per share, and you only need enough money in your settlement fund to cover the cost of the stocks you want to buy. Pay no commission when you buy or sell stocks and ETFs (exchange-traded funds) online at Vanguard. The price of preferred stock, however, doesn’t move as much as common stock prices.

How old do you have to be to buy stocks?

Please be careful to read any information provided on their sites. Buying stocks is an important part of many people’s investing plans. It isn’t a complicated process, but it does involve a few steps and, if you’re doing it right, a decent amount of preparation. Before you find a broker and actually buy the stocks, make sure you’ve gone over your finances and know which stocks you want to buy that will help you achieve your financial goals.

“I’d like to start investing in my employer’s 401(k).” This is one of the most common ways for beginners to start investing. To learn more about ESRT and its stock, please read our disclosures that are available on our Investor Relations webpage (click here) and filed with the U.S. To learn more about the padlock next to the price, please click here. When you find an attractive stock, note its ticker symbol, typically a three- or four-letter code.

Buy Amazon Stock, but Avoid Apple for Now, Says Analyst

Be sure to pay attention to valuation, or what you’re paying compared to what you’re getting as a shareholder. Our experts have been helping you master your money for over four decades. We continually strive to provide consumers with the expert advice and tools needed to succeed throughout life’s financial journey. We are an independent, advertising-supported comparison service. Paramount (PARA) shares rose after reporting second quarter results that beat analyst estimates on both the top and bottom lines. The company also announced private equity firm KKR (KKR) will be buying its Simon & Schuster business for $1.62 billion in an all-cash deal.

The next step is to actually put money into your account so that you have the funds to invest. This can be done by sending a physical check through the mail, but it’s much more convenient to set up an electronic transfer. To transfer funds electronically, you’ll provide the account information and the financial institution which you’d like to transfer money from. Beginners interested in buying a stock should understand that it’s simple to place a trade. But the hardest steps in the process are researching your investments and continuing to follow your stocks after you’ve bought them.

$0 online listed equity trade commissions + Satisfaction Guarantee.

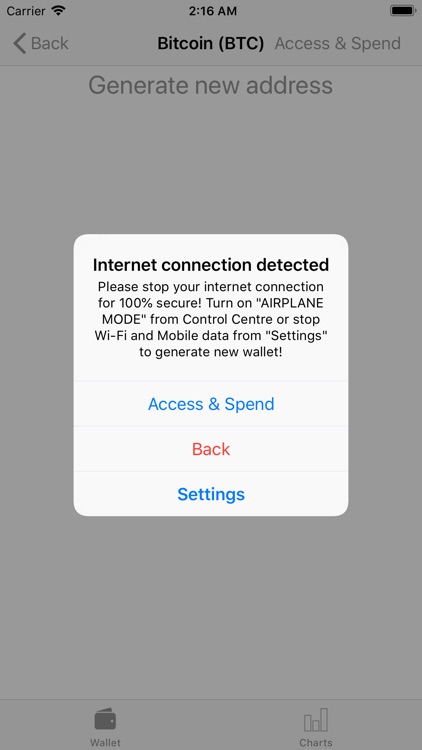

That doesn’t make robo-advisors a bad choice for your investing dollars, especially if you’re more of a hands-off investor. Just keep in mind that robo-advisors may not be your first choice if you want to buy stocks. You’ll need a brokerage account with an online broker, which can be opened in just a few minutes with some basic personal information, as well as a way to fund your account. Funds can be deposited by check or through an electronic transfer. Before buying any stock, you’ll want to do some research on the companies you’re considering. Buying a stock is only part of the process of being a stockholder.

Is It Too Late to Buy Nikola Corporation Stock? – The Motley Fool

Is It Too Late to Buy Nikola Corporation Stock?.

Posted: Tue, 08 Aug 2023 14:23:00 GMT [source]

Building a diversified portfolio out of many individual stocks is possible, but it takes a significant investment and research. “I’d like an expert to manage the process for me.” You may be a good candidate for a robo-advisor, a service that offers low-cost investment management. Virtually all of the major brokerage firms and many independent advisors offer these services, which invest your money for you based on your specific goals. A broker will allow you to invest in different types of assets, including stocks, bonds, mutual funds, certificates of deposit (CD), real estate investment trusts (REITS), and other investment opportunities. The number of shares of stock you should buy depends entirely on your investment goals, risk tolerance and financial situation. Consider the amount of money you can afford to invest and the amount of risk you are willing to take.

Questions to ask yourself before you trade

Others try to work with the market to balance high- and low-risk investments to maximize their returns. Investing in stocks can give you the flexibility to buy and sell as you please. Some stocks pay dividends, which is extra money you see immediately rather than when you sell a share. Of course, investing in stock comes with some risk due to the stock market’s own volatility. In turn, it’s crucial that you understand stocks before you invest your hard-earned money.

- The following topics provide additional information about stock investing and trading.

- An important additional difference between common stock and preferred stock has to do with what happens if the company fails.

- Any changes to analyst ratings on a company’s stock (from a “buy” to a “sell,” for instance) has the potential to impact the stock’s price.

- More specifically, it’s the dollar value of the company, calculated by multiplying the number of outstanding shares by the current market price.

- You can open an account with an online brokerage, a full-service brokerage (a more expensive choice) or a trading app such as Robinhood or Webull.

- Crockett has shifted his stance, noting that Apple’s long upward trend has put it at a peak valuation, and that it’s simply not possible to predict future successful products.

Some brokerages also have minimums for the amounts you must deposit. For instance, a brokerage may only accept deposits of at least $1,000 or $500. Be sure to check any limitations with your brokerage beforehand. That also means that deciding when you should sell a stock ut eproxy has very little to do with what the stock or broader markets are doing at any given moment. Unless you’re day trading and looking to turn a quick profit—which is much riskier than long-term investing—you don’t even have to worry about watching day-to-day price movements.

But a slowdown in the U.S. seems likely to last until a material new product category takes hold. And that is uncertain both in timing and success, leaving little reason to favor shares now trading near peak absolute and relative multiples,” Crockett says of the stock, in his recent note. By knowing what each order does and how each one might affect your trading, you can identify which order suits your investment needs, saves you time, reduces your risk, and, most importantly, saves you money.

- For example, Bank of America owns Merrill Edge, J.P. Morgan Chase offers J.P.

- In contrast, some industries, such as travel and luxury goods, are very sensitive to economic ups and downs.

- You can start your investment journey with a small sum of money.

- Some years stocks may fall 20 to 30 percent, while in other years they may rise similarly.

- System response and account access times may vary due to a variety of factors, including trading volumes, market conditions, system performance, and other factors.

That’s because it is relatively rare for the stock market to experience a downturn that lasts longer than that. The S&P 500 is an index consisting of about 500 of the largest publicly traded companies in the U.S. Over the last 50 years, its average annual return has been more or less the same as that of the market as a whole — about 10%. When you invest in stocks, you’re hoping the company grows and performs well over time. We believe everyone should be able to make financial decisions with confidence. This website does not constitute an offer to sell, a solicitation of an offer to buy, or a recommendation of ESRT stock.

Your portfolio should immediately update to reflect your ownership of the newly purchased shares. In this article, we won’t go to deep into the many possible methods of analyzing and selecting individual stocks to buy. However, the next step is to determine which stocks you’d like to purchase. Investing in stocks will allow your money to grow and outpace inflation over time. As your goal gets closer, you can slowly start to dial back your stock allocation and add in more bonds, which are generally safer investments. Yes, as long as you’re comfortable leaving your money invested for at least five years.