A demand for raising funds generates a new capital structure since a decision has to be made at to the quantity and forms of financing. The debt- equity mix has implications for the shareholders’ earning and risk, which in turn will affect the cost of capital and the market value of the firm. These funds can be procured from different types of investors i.e., equity shareholders, preference shareholders, debt holders, depositors etc. These investors while providing the funds to the firm will have an expectation of receiving a minimum return from the firm.

What are the 6 factors affecting capital structure?

Some main factors include the firm's cost of capital, nature, size, capital markets condition, debt-to-equity ratio, and ownership.

When the rupee weakens, exactly the opposite happens, that is the stock prices of exporters go up, while those of importers go down. Current events that affect the stock market include any political turmoil, civil war or riots, or terrorist attacks. All these events are bound to make stock prices go down drastically and affect the market volatility.

Let’s try to understand how the cost of capital affects small businesses. Hope everything related to the capital structure is clear now, and if not, please drop comments below. If you want to manage your capital structure better, it’s essential to keep track of profit and loss ratios.

Accountancy and Financial Management – Notes | Study Accountancy and Financial Management – B Com

But the company should go for equity if they are not sure if they can cover the fixed cost of interest. A business raises funds from various sources, mainly categorized under two heads, namely equity and debt. In case of equity, investors will provide capital in exchange for a percentage of the profits – i.e. a stake in the business. In the case of debt, a business will take business loans from banks, NBFCs and such other institutions – the repayment being in the form of interest, and eventually, the principal amount. Capital structure is the combination of equity and debt a company uses for its overall growth and operations. Equity capital is derived from ownership shares and claims to future profits and cash flows.

What are the three factors that affect the cost of capital beyond firm’s control?

- Factor 1: The tax rate. The tax rate is decided by by the legislative body.

- Factor 2: The risk free rate. The risk free rate affects the cost of all securities.

- Factor 3: The market risk premium.

Note that financial specialists will want to see a discounting study when the entity proposes investments, actions, or business case scenarios. The financial risk is a type of risk which can affect the cost of capital of the firm. The particular composition and mixing of different sources of finance, known as the financial plan or the capital structure, can affect the return available to the investors. The financial risk is affected by the capital structure or the financial plan of the firm. Higher the proportion of fixed cost securities in the overall capital structure, greater would be the financial risk. For the first time, Modigliani and Miller argued that in a tax free world, the capital structure decisions are irrelevant and the value of the firm is independent of its capital structure.

The Website may assign or delegate its rights and/or obligations under this Agreement to any other party in future, directly or indirectly, or to an affiliated or group company. However, you are responsible for all telephone access fees and/or internet service fees that may be assessed by your telephone and/or internet service provider. You further agree to pay additional charges, if any levied by Third Party Service Provider, for the facilities provided by them through the Website . Information published on the Website may contain references or cross references to products, programs and facilities offered by ABC Companies/third parties that are not announced or available in your country. Such references do not imply that it is intended to announce such products, programs or facilities in your country.

Capital Structure in Financial Management

This WACC can then be used as a reduction fee for a project’s projected free cash flows to the agency. You can either calculate the cost of equity through the use of the capital asset pricing mannequin or the dividend capitalization mannequin. It may also be estimated by finding the cost of fairness of projects or investments with similar danger.

What are factors affecting the cost of capital can be controlled by the firm?

A firm can affect its cost of capital through its capital structure, dividend policy and investment policy.

The data allows users to review debt instruments by their ultimate issuer and immediate parent company, enabling them to spot the patterns and trends in the structure over time. In order to avoid the cumbersome procedure of trial and error to find out the value of kd in Equation 5.3, Equation 5.4 may be used to give an approximation to after tax cost of capital of debt. The firm has a specific cost of capital for each of these sources and on the basis of these specific cost of capital, the overall cost of capital of the firm can be determined. Just write the bank account number and sign in the application form to authorise your bank to make payment in case of allotment. Beta reflects the changes in the price of the stock relative to the changes in the market.

It consists of Equity Capital, Net Worth, Total Borrowing and Reserves and Surplus. Now keep track of your cash flow and manage your incomes and expenses with ease by using the Cashbook app by Khatabook. High ICR means companies can have more of borrowed fund securities whereas lower ICR means less borrowed fund securities.

Neither ABCL and ABC Companies, nor their officers, employees or agents shall be liable for any loss, damage or expense arising out of any access to, use of, or reliance upon, this Website or the information, or any website linked to this Website. You also acknowledge and agree that, unless specifically provided otherwise, these Terms of Use only apply to this Website and facilities provided on this Website. This Agreement describes the terms governing the usage of the facilities provided to you on the Website. Clicking “I Agree” to “Terms & Conditions”, shall be considered as your electronic acceptance of this Agreement under Information Technology Act 2000. If you’re an aggressive investor, stock trading is the best way to gain maximum returns, build a good corpus and achieve your life goals. They first issue secured debt and then unsecured debt followed by hybrid securities such as convertible debentures.

FAQs on Capital Structure

Capital budgeting decisions use the structural equation modeling approach after undergoing factor analysis, which results in a better developed model after various rotations with different variables for arriving at the best fit structural model. However, the firms with greater liquid assets may use these assets to finance their investments. If this happens there will be a negative relationship between the firm’s liquidity ratio and the debt ratio. Moreover, as Prowse argues that liquidity of the company assets can be used to show the extent to which these assets can be manipulated by shareholders at the expense of bondholders.

Normally long- term finance such as equity and debt consist of fixed cost while mobilization. When the cost of capital increases, value of the firm will also decrease. The cost of retained earnings must be considered as the opportunity cost of the foregone dividends. From the point of view of equity shareholders, any earning retained by the firm could have been profitably invested by the equity shareholders themselves, had these been distributed to them. Thus, there is an opportunity cost involved in the firms retaining the earnings and an estimation of this cost can be taken up as a measure of cost of capital of retained earnings, kᵣ. Normally, the capital funds come from a pool of different sources, none of the elements of which can or should be specifically identified with the particular proposals under review.

- Different companies have different capital structures, so it is crucial to understand how they work and what works best for each.

- Equation 5.5 is to be solved by the trial and error procedure to find out the value of kp.

- Conceptually, the cost of capital as a measure represents the combined cost of total funds being used by the firms.

- One such factor may be the liquidity or marketability of the investment.

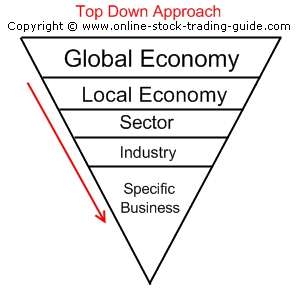

In this section an attempt has been made to briefly discuss the various determinants of capital structure of the firm. Anand’s analysis of capital structure finds that the retained earnings are the most preferred source of finance followed by debt and then equity. The results seem to suggest that firms do not have specific capital structure in mind when deciding as to how best to finance their projects. Low growth firms prefer more use of debt in their capital structure vis-à-vis the high growth firms.

It equals the speed of return on a challenge or investment with comparable danger. A company’s cost of capital is the rate of return the company would earn if it invested its capital in an organization of equal threat. Because of tax advantages on debt issuance, it will be cheaper to concern debt somewhat than new fairness . At some point, nonetheless, the price of issuing new debt shall be higher than the price of issuing new equity.

Demand and Supply of Capital:

A stock market exchange, like the Bombay Stock Exchange and the National Stock Exchange, BSE and NSE in short, respectively, are stock exchange mediators that allow buying and selling stock. In the most basic of terms, when someone opens a company, they alone or a group of people who funded the company are sole owners of the company. The profitability coefficient of -0.04 indicates that profitability is negative related to debt-equity ratio.

One can easily find beta online or it can be calculated using regression. A beta greater than 1 reflects more volatility of stock as compared to the market and vice versa. DISCLAIMER The information contained herein is generic in nature and is meant for educational purposes only. Nothing here is to be construed as an investment or financial or taxation advice nor to be considered as an invitation or solicitation or advertisement for any financial product.

Explain long-term investment decision and state any two factors affecting this decision. So there’s a constant turmoil whether to pay more for capital or give up control. Thus, the company can opt for a higher proportion of debt in the capital structure and vice versa. Having considered what cost of capital means to a small business, and the factors that influence it, let’s understand how it is actually calculated. Unlike larger organizations that hire dedicated teams for working capital management, for smaller businesses, the onus might fall on the owner or the core team. Keeping a check on day-to-day needs might be cumbersome, leading to situations where there might be a disconnect between demand and supply.

You may consult your local advisors for information regarding the products, programs and services that may be available to you. This Website is controlled and operated from India and there is no representation that the Materials/information are appropriate or will be available for use in other locations. If you use this Website from outside the India, you are entirely responsible factors affecting cost of capital for compliance with all applicable local laws. There is no warranty or representation that a user in one region may obtain the facilities of this website in another region. Further, the Facilities Provider cannot always foresee or anticipate technical or other difficulties. These difficulties may result in loss of data, personalization settings or other facilities interruptions.

What are the 5 factors affecting capital structure?

The key factors affecting capital structure include industry leverage, growth opportunities, asset tangibility, expected inflation, profitability, firm size and stock market return.