Contents

Do you want to know how to trade the forex market without losing a dime? Then go over to hereyou will get tons of information there. Your goal if you don’t have one, should be to find a strategy that works and stick too it.

It’s pretty common for new Forex traders to think making money through online Forex trading is fast and easy. This is more informative to know about forex trading. Too many enter forex trading thinking it is a get-quick-rich opportunity. ‘9 Things You Didn’t Know About Successful Forex Traders in 2020’ article is very nice. Every trader can learn how to trade forex from your article. Always when I read your article I get excited and it doesn’t matter how many times I go through it every time its like its my first time reading it.

- If you want to start trading forex right away or are looking for a better online broker to partner with, check out Benzinga’s top picks for forex brokers in the table below.

- Stop-loss orders are an essential forex risk management tool since they can help traders cap their risk per trade, preventing significant losses.

- A person can also apply all the secrets when demo trading and can see if the secrets really work.

- Next, you need to write down your trading strategy in your trading plan while clearly describing your rules of engagement.

- Every chapter goes into actionable steps that will allow you to set up your first trading account and be profitable from the start.

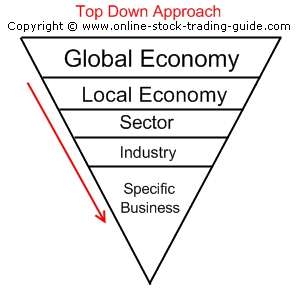

Trade with risk capital only — this is money that you can afford to lose. Many successful strategies for trading forex exist, but not all of them are suitable for every trader. Select a strategy that best suits your particular situation, including your available lexatrade time, personality type and risk tolerance. These are covered below based on the typical time involved, ranging from short to long term. The big advantage of having a forex trading strategy is that you can take some of the guesswork out of trading currencies.

Forex trading tip #7: Don’t put your stop loss at the same place as everyone else. Here’s what you should do instead…

Therefore, often times when significant trading moves occur off pivot levels, there is really no fundamental reason for the move other than a lot of traders have placed trades expecting such a move. Paying attention to daily pivot points is especially important if you’re a day trader, but it’s also important even if you’re more of a position trader, swing trader, or only trade long-term time frames. Because of the simple fact that thousands of other traders watch pivot levels. Hi Rayner…Thax for your effort, time and money you investing in helping most of us, of which you don’t even know and you may even not ever come across. I have lost over R150k so far to fake Forex gurus and placing wrong trades due to lack of trading experience and teaching like yours.

After the win, you’re feeling excited and proud of yourself, and you have every right to be. Similarly, don’t allow the money to be your sole reason for trading. The desire for money is probably what attracted you to trading in the first place, but don’t let it be your only desire. In other words, trading Forex to gain a certain amount of money within a specific time period. It’s much easier to risk 2% without fully accepting the potential loss because it doesn’t carry the emotional value that money does. However, I’m just as interested in the dollar amount at risk as the percentage of my account balance.

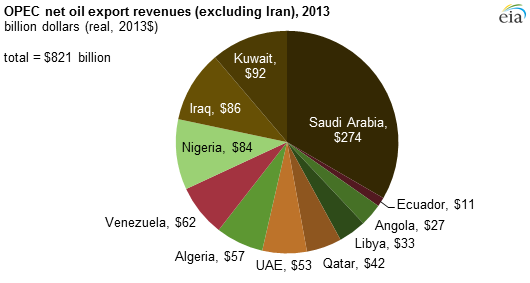

The only requirement in the Forex trading is the account that a person is required to open with reliable and registered brokers, a computer system and fast internet connection. Diversification is also highly necessary to risk management in forex trading. Diversification is not setting all your eggs in one basket. For example, moneyball the art of winning an unfair game if you just trade the USD upon the GBP, you are particularly responsive to that currency issue. If you trade various currencies, you can avoid difficult situations and continue trading when your initial money is down. CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage.

Day Trading

It has become incredibly popular over the last few years not because of its tranquility but because of its volatile nature. Seems sort of strange, but there is a good reason for it. Trade with a purpose – A large part of your trading requires your emotion. Therefore, you don’t have to trade because you feel like doing that. Trading is a risky adventure, which is why you need to risk only money you are willing to lose. If you want to enter the market, do that with a purpose and not just random trading.

Here are a few areas to keep in mind when setting goals for forex trading. It is important to set a goal in our lives, whether it is business-related, health-related or trading-related. Goals provide guidance, something that aims while trading on the forex market and offers a sense of achievement every time a target is achieved. With that, if you didn’t use any money management strategy till now, I highly recommend you to implement a one. The main object of good money management is to focus on one thing alone, and that is account performances. Therefore stop getting frustrated after having a negative month.

Get Started

Swing Trading opens up the world to you in a way few trading books do. Dispensing with fluff and circumspect, it will dig into the world of trading and show you exactly what needs to be done to see your account grow every week. This book is an excellent beginners’ guide to learn about trading options. Now almost anyone with a computer and an Internet connection can trade currencies just like the world’s largest banks do. Now, you have to be careful when opening a Forex account with any broker because some could be SCAM.

Short-term scalping, by definition, means small profits or losses. In this case, you will have to trade more frequently. Placing stop-loss orders wisely is one of the abilities that distinguish successful traders from their peers.

They blow out their account before they ever have a chance to enter what turns out to be a hugely profitable trade. In forex trading, avoiding large losses is more important than making large profits. That may not sound quite right to you if you’re a novice in the market, but it is nonetheless autochartist oanda true. Winning forex trading involves knowing how to preserve your capital. Forex trading is often hailed as the last great investing frontier – the one market where a small investor with just a little bit of trading capital can realistically hope to trade their way to a fortune.

The Commodity Futures Trading Commission in US has jurisdiction over all Futures and Forex activity. When trading in the foreign exchange markets, individuals should only trade with a CFTC registered entity that is also a member of the National Futures Association and is regulated by the CFTC. For non-US broker/ bank entities, be sure that the broker or bank is registered with that country’s appropriate regulatory bodies. Unfortunately, only few Forex traders are actually aware of this information. One of these strategies is to use a simple-moving average. This is where we extract a set of averages from previous existing spikes.

Samantha Silberstein is a Certified Financial Planner, FINRA Series 7 and 63 licensed holder, State of California life, accident, and health insurance licensed agent, and CFA. She spends her days working with hundreds of employees from non-profit and higher education organizations on their personal financial plans. Once you know what to expect from your system, have the patience to wait for the price to reach the levels that your system indicates for either the point of entry or exit. If your system indicates an entry at a certain level but the market never reaches it, then move on to the next opportunity. Charles is a nationally recognized capital markets specialist and educator with over 30 years of experience developing in-depth training programs for burgeoning financial professionals. Charles has taught at a number of institutions including Goldman Sachs, Morgan Stanley, Societe Generale, and many more.

If nothing else, it will provide a solid foundation from which you can design and develop other strategies. It’s your passion for trading, not money, that will push you through the tough times. Without passion and a love for trading, no amount of money can make you a successful Forex trader. How would you like to be able to potentially make money trading currencies in the Forex markets? Better yet, how would you like to be able to potentially do this within strict risk control parameters?

Give Your Best to Control What You Can Control

Some like to trade using indicators, such as MACD and crossovers. Like any other investment arena, the forex market has its own unique characteristics. In order to trade it profitably, a trader must learn these characteristics through time, practice, and study. If you guessed that Trader #1 is the super-successful, professional forex trader, you probably guessed wrong. In fact, the portrait drawn of Trader #2 is closer to what a consistently winning forex trader’s operation more commonly looks like. I do miss a lot of trades because I like to see a return to the support or resistance.

Ever since I started focusing profusely on your free videos and almost all of your notes my trading skill and experience have taken a different shift.. Regardless of the timeframes you use, whether you rely ontechnical analysisorfundamental analysis, always follow your trading plan. Control your emotions and be patient enough to wait for your trade setups to be confirmed before opening/closing a position.

Here are the secrets to winning forex trading that will enable you to master the complexities of the forex market. If the price consolidates at resistance, but the higher timeframe is in a downtrend, then the breakout is probably not going to happen. Yes, you can be a profitable trader by looking only at one timeframe, especially if you’re a systematic trader or a quantitative trader. To the seasoned price action trader, this is a sign of strength from the buyers.

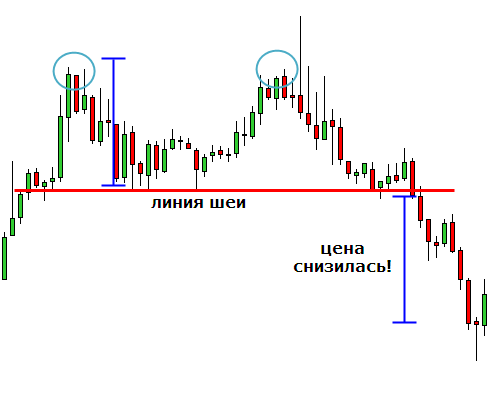

But instead of throwing in the towel, he used that loss to fuel his passion for learning. Duquesne Capital Management is famous for posting an average annual return of 30 percent without a losing year. CedarFX is not regulated by any major financial agency. The brokerage is owned by Cedar LLC and based in St. Vincent and the Grenadines. See that is why setting realistic expectation is such an important in trading. Downtrend Stage – This stage is basically a downtrend of lower lows and a lower high of prices.